UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ¨x Filed by a Party other than the Registrant ¨

Check the appropriate box:

|

| |

X ¨ | Preliminary Proxy Statement |

| | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

¨x | Definitive Proxy Statement |

| | |

| ¨ | Definitive Additional Materials |

| | |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

Boston Private Financial Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

X No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

| |

| (1) | Title of each class of securities to which transaction applies: |

| |

| (2) | Aggregate number of securities to which transaction applies: |

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11(Set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| (4) | Proposed maximum aggregate value of transaction: |

Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| |

| (1) | Amount Previously Paid: |

| |

| (2) | Form, Schedule or Registration Statement No.: |

BOSTON PRIVATE FINANCIAL HOLDINGS, INC.

Ten Post Office Square

Boston, Massachusetts 02109

Dear Fellow Shareholders:

On behalf of the Board of Directors and the management of Boston Private Financial Holdings, Inc. (the "Company"“Company”), you are invited to attend the Company's 2013Company’s 2015 Annual Meeting of Shareholders. The meeting will be held on l, l, 2013Wednesday, April 15, 2015 at l:10:00 l.m.,a.m. Eastern time, at Ten Post Office Square, 2nd Floor, Boston, Massachusetts 02109.

The attached Notice of the 2015 Annual Meeting of Shareholders and Proxy Statement describe the formal business to be conducted at the meeting. Please refer to the Proxy Statement for detailed information on each of the proposals. Only shareholders of record at the close of business on l, 2013,March 4, 2015 may vote at the meeting or any postponements or adjournments of the meeting.

On behalf of the Board of Directors and all employees of Boston Private Financial Holdings, Inc., I thank you for your continued support of our Company.

YOUR VOTE IS VERY IMPORTANT. Whether or not you plan to attend the 2015 Annual Meeting of Shareholders, please vote in order to ensure the presence of a quorum.

|

|

| |

| Sincerely, |

| |

/s/ CLAYTON G. DEUTSCH |

| Clayton G. Deutsch |

| Chief Executive Officer and President |

| |

| Boston, Massachusetts |

| Dated: March 13, 2015 |

YOUR VOTE IS VERY IMPORTANT. PLEASE VOTE WHETHER OR NOT YOU PLAN TO

ATTEND THE MEETING.

BOSTON PRIVATE FINANCIAL HOLDINGS, INC.

Ten Post Office Square

Boston, Massachusetts 02109

NOTICE OF 2015 ANNUAL MEETING OF SHAREHOLDERS

To Be Held on l, l, 2013

NOTICE IS HEREBY GIVEN that the 2013 Annual Meeting of Shareholders of Boston Private Financial Holdings, Inc. (the "Company") will take place at Ten Post Office Square, 2nd floor, Boston, Massachusetts 02109 on l, l, 2013 at l:00l.m., Eastern time, for the following purposes: |

| | |

1.TIME AND DATE PLACE | to | 10:00 a.m. Eastern Time, Wednesday, April 15, 2015

Ten Post Office Square

Boston, Massachusetts 02109 |

| ITEMS OF BUSINESS | (1) | To elect the fournine director nominees named in the Proxy Statement to serve until the 20142016 annual meeting and until their successors are duly elected and qualified; |

| qualified. |

2. | to(2) | To approve aan advisory, non-binding advisory resolution regardingon the compensation of the Company's named executive officers; |

| officers as disclosed in the Proxy Statement. |

3. | to amend(3) | To ratify the Company's Restated Articlesselection of Organization to eliminateKPMG, LLP as the supermajority voting requirementCompany’s independent registered public accounting firm for removal of directors; |

| fiscal 2015. |

4. | to amend the Company's Restated Articles of Organization to eliminate the supermajority voting requirement for amending the Restated Articles of Organization; and |

| (4) | |

5. | toTo transact any other business that may properly come before the meeting. |

| RECORD DATE | | Only shareholders of record at the close of business on March 4, 2015 may vote at the meeting or any postponements or adjournments of the meeting. |

| PROXY VOTING | | Your vote is very important. Please complete, date, sign and return the accompanying proxy card or vote electronically via the Internet or by telephone. The enclosed return envelope requires no additional postage if mailed in the United States. For specific instructions on how to vote your shares, please refer to the section entitled “Voting Options.” |

Only shareholders of record at the close of business on l, 2013 may vote at the meeting or any postponements or adjournments of the meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF

PROXY MATERIALS FOR THE MEETING

The Company's Annual Report on Form 10-K for the period ending December 31, 2012 and the 2013 Proxy Statement are available at www.edocumentview.com/bpfh. These documents are also available free of charge by calling the Company's toll-free number (888) 666-1363 or by contacting the Company's investor relations department by email at investor-relations@bostonprivate.com.

Your vote is very important. Please complete, date, sign and return the accompanying proxy card or vote electronically via the Internet or by telephone. The enclosed return envelope requires no additional postage if mailed in the United States. For specific instructions on how to vote your shares, please refer to the section entitled "Proxy Voting Options." We look forward to your attendance in person or by proxy.

By Order of the Board of Directors,

MARGARET W. CHAMBERS

Corporate Secretary

Boston, Massachusetts

Dated: l, 2013March 13, 2015

Important Notice Regarding the Availability of Proxy Materials for the 2015 Annual Meeting of Shareholders to be held on Wednesday, April 15, 2015. The Company’s Annual Report on Form 10-K for the period ending December 31, 2014 and the 2015 Proxy Statement are available at www.edocumentview.com/bpfh. These documents are also available free of charge by calling the Company’s toll-free number (888) 666-1363 or by contacting the Company’s investor relations department by email at investor-relations@bostonprivate.com.

TABLE OF CONTENTS

BOSTON PRIVATE FINANCIAL HOLDINGS, INC.

Ten Post Office Square

Boston, Massachusetts 02109

PROXY STATEMENT

Annual Meeting of Shareholdersfor the

To be held on l, l, 20132015 ANNUAL MEETING OF SHAREHOLDERS

GENERAL

The Company'sCompany’s Board of Directors (the "Board"“Board”) is furnishing youmaking this Proxy Statement and solicits your proxyavailable to you in connection with the solicitation of proxies by our Board for the 20132015 Annual Meeting of Shareholders (the "Meeting"“Meeting”). The Meeting will be held on lWednesday, April 15, 2015 at l:10:00 l.m,a.m. Eastern time, at Ten Post Office Square, 2nd Floor, Boston, Massachusetts 02109.

VOTING AND QUORUMINFORMATION

Record Date.The record date for the Meeting is March 4, 2015 (the “Record Date”). At the close of business on the Record Date, there were 83,120,436 shares of the Company’s common stock entitled to be voted at the Meeting, and there were 1,070 shareholders of record. There are no other outstanding shares that are eligible to vote.

Voting Your Proxy.l, 2013 (the "Record Date"). Only shareholders of record at the close of business on the Record Date are entitled to vote at the Meeting. Shareholders of the Company's outstanding common stock, par value $1.00 per share, and Series B preferred stock, par value $1.00, are entitled to vote at the Meeting. Each outstanding share of common stock is entitled to one vote on each matter before the Meeting. Each outstanding share of Series B preferred stock is entitled to vote, separate from the shares of common stock, on Proposal 4. At the close of business on the Record Date, there were

lVote Required. shares of the Company's common stock and 401 shares of the Company's Series B preferred stock outstanding and entitled to be voted at the Meeting, and there were l shareholders of record.

A quorum of the common stock must be present at the Meeting for any business to be conducted. In addition, a quorum of the Series B preferred stock must be present for a vote on Proposal 4. The presence, in person or by proxy, of the holders of at least a majority of the votes entitled to be cast on a matter for each voting group constitutes a quorum. Abstentions will be counted for purposes of determining whether a quorum is present. Broker non-votes will not be counted for purposes of determining whether a quorum is present. If a quorum is not present, the Meeting will be adjourned until a quorum is obtained.

Director nominees under Proposal 1 must receive a plurality of the votes cast by shareholders in order to be elected. A proxy vote that withholds authority to vote for a particular nominee or nominees and broker non-votes will have no effect on the outcome of the election of the nominees.

The approval of Proposal 2 to approve the advisory, non-binding advisory resolution on executive compensation requires the affirmative vote of a majority of the votes cast at the Meeting. Abstentions and broker non-votes will have no effect on the outcome of the votes for this proposal.

The approvalratification of Proposal 3 to amend the Company's Restated Articlesselection of Organization to eliminate the supermajority voting requirement for the removal of directorsCompany’s registered independent public accounting firm requires the affirmative vote of not less than two-thirdsa majority of the total votes eligible to be cast at the Meeting. Abstentions and broker non-votes will have the same effect as a vote AGAINST Proposal 3.

The approval of Proposal 4 to amend the Company's Restated Articles of Organization to eliminate the supermajority voting requirement for amending the Restated Articles of Organization requires (i) the affirmative vote of not less than two-thirds of the total votes eligible to be cast at the Meeting and (ii) the affirmative vote of 66 2/3% of the outstanding Series B preferred stock, voting as a single class. Abstentions and broker non-votes will have the same effect as a vote AGAINST Proposal 4.

We are first sending this Proxy Statement and the accompanying materials to shareholders on or about l, 2013.March 13, 2015.

PROXY VOTING OPTIONS

Whether or notYour vote is very important. Even if you expectplan to be present atattend the Meeting you are requested toin person, please cast your vote your shares at your earliest convenience. Promptly voting your shares will ensure the presence of a quorum at the Meeting.as soon as possible by:

Voting by Mail:Mail. The accompanying proxy card, if properly completed, signed, dated and returned in the enclosed envelope, will be voted in accordance with your instructions. The enclosed envelope requires no additional postage if mailed in the United States.

Voting via the InternetTelephone or by Telephone:Internet. If you hold your shares of common stock directly and not in street name, you may vote via the Internet or by telephone or Internet by following the instructions included on your proxy card. If you vote via the Internet or by telephone or Internet, you do not have to mail in your proxy card. InternetTelephone and telephoneInternet voting are available 24 hours a day. Votes submitted through the Internet or by telephone or Internet must be received by 2:00 a.m., Eastern time, on l, 2013. Please do not return the enclosed proxy card if you are voting via the Internet or by telephone.April 15, 2015.

Voting in Person at the Meeting:Meeting. If you are a registered shareholder as of the Record Date and attend the Meeting, you may deliver your completed proxy card in person. Additionally, we will have ballots available for those registered shareholders as of the Record Date who wish to vote in person at the Meeting.

A shareholder of record may revoke a proxy any time before the polls close by submitting a later dated vote via the Internet, by telephone, byInternet, or mail, or by delivering instruments to the Corporate Secretary before the Meeting or by appearing in person at the Meeting and specifically withdrawing any previously voted proxy.

PLEASE DO NOT RETURN THE ENCLOSED PROXY CARD IF YOU ARE 1

VOTING VIA THE INTERNET OR BY TELEPHONE.

PROXIESMATTERS AND VOTING RECOMMENDATIONS

By submitting your proxy (either by signing and returningone of the enclosed proxy card or by voting electronically via the Internet or by telephone),methods listed above, you authorize Margaret W. Chambers, Executive Vice President, General Counsel and Corporate Secretary, and David J. Kaye, Executive Vice President, Treasurer and Chief Financial Officer, to represent you and vote your shares at the Meeting in accordance with your instructions. If a properly executed proxy is submitted and no instructions are given, the proxy will be voted in accordance with the Board'sBoard’s recommendations as follows:

FOR the four director nominees for election to the Board of Directors; |

| | | | | |

| Proposal | | | Board Recommendation | | Page Reference (for more detail) |

| Item 1 | Elect the nine director nominees named in this Proxy Statement to serve until the 2016 annual meeting and until their successors are duly elected and qualified. | | FOR each Director Nominee | | |

| Item 2 | Approve an advisory, non-binding resolution on the compensation of the Company’s named executive officers. | | FOR | | |

| Item 3 | Ratify the selection of KPMG, LLP as the Company’s independent registered public accounting firm for fiscal 2015. | | FOR | | |

FOR the non-binding, advisory resolution regarding the compensation of the Company's named executive officers;

FOR the approval of the amendment to the Company's Restated Articles of Organization to eliminate the supermajority voting requirement for the removal of directors; and

FOR the approval of the amendment to the Company's Restated Articles of Organization to eliminate the supermajority voting requirement for amending the Restated Articles of Organization.

OTHER MATTERS

As of the date of this Proxy Statement, the Board of Directors is not aware of any other matters to be considered at the Meeting. If any other matters properly come before the Meeting, the proxies will be voted at the discretion of the proxy holders.

ANNUAL REPORT

All shareholders of record are being sent a copy of the Company's 2012Company’s 2014 Annual Report to Shareholders and the Annual Report on Form 10-K for the fiscal year ended December 31, 2012,2014, which contains audited financial statements of the Company for the fiscal years ended December 31, 2012, 20112014, 2013 and 2010,2012, as filed with the Securities and Exchange Commission ("SEC"(“SEC”) on l, 2013.March 2, 2015. These reports, however, are not part of the proxy soliciting material.

A copy of the Company'sCompany’s Annual Report on Form 10-K filed with the SEC, including all exhibits, may be obtained free of charge by writing to Boston Private Financial Holdings, Inc., Ten Post Office Square, Boston, Massachusetts 02109, Attention: Corporate Secretary, or by accessing the "Investor Relations" section of the Company'sCompany’s website at www.bostonprivate.com, and selecting the link “Documents/SEC filings” under "Documents/SEC filings."the “Investor Relations” tab.

PROPOSAL 1

ELECTION OF DIRECTORS

The Company'sCompany’s Restated Articles of Organization, as amended to date, provide that beginning at the 2013 Annual Meeting of Shareholders (“2013 Meeting”), directors shall be elected annually for terms of one year, except that any director in office at the 2013 Meeting whose three-year term expires at the annual meeting of shareholders to be held in calendar year 2014 orand 2015 shall continue to hold office until the end of the three-year term for which such director was elected and until such director'sdirector’s successor shall have been elected and qualified. At the annual meeting of shareholders to be held in 20162015 and at each annual meeting of shareholders thereafter, all directors shall be elected for terms expiring at the next annual meeting of shareholders and until such directors'directors’ successors shall have been elected and qualified.

The Board of Directors of the Company currently consists of ten members. At this year’s annual meeting, shareholders will be asked to elect nine members. The termsdirectors, eight of four members - Eugene S. Colangelo, Clayton G. Deutsch, Allen L. Sinai, and Stephen M. Waters - expirewhom are currently serving as directors of the MeetingCompany. Mrs. Hoffman and these directorsMr. Alexander will not stand for re-election atre-election. After evaluating the Meeting asperformance and experience of each of the current Directors and the composition of the full Board, the Compensation, Governance and Executive Committee of the Board has recommended one new director nominee for election to fill one of the vacant seats. This nominee is Mark D. Thompson. Each of the nine director nominees proposed by the Board.

Each nominee has agreed to continueconsented to serve as a Directordirector if re-elected.elected at this year’s annual meeting. Each nominee elected as a director will serve until the next annual meeting and until his or her successor has been elected and qualified. If any nominee shall become unavailable for any reason, all proxies will be voted FORis unable to serve as a director at the election of such other person asannual meeting, the Board may reduce the number of Directors may recommend.

The Board of Directors unanimously recommends a vote FOR each of its four nominees.

INFORMATION REGARDING DIRECTORS

The following table sets forth certain information regarding the Directors of the Company, including the nominees for electiondirectors to be elected at the 2013 Annual Meeting of Shareholders, based on information furnished by them to the Company:annual meeting.

|

| | | | | |

| | | Age | | Director Since |

Directors Nominated for Election at the 2013 Annual Meeting of Shareholders

| | | | |

| Eugene S. Colangelo *(1)(2) | Westborough, MA | 65 |

| | 1987 |

| Clayton G. Deutsch (2) | Boston, MA | 57 |

| | 2010 |

| Allen L. Sinai *(2) | Lexington, MA | 73 |

| | 1995 |

| Stephen M. Waters #*(2) | Greenwich, CT | 66 |

| | 2004 |

| | | | | |

| Directors Whose Terms Expire at the 2014 Annual Meeting of Shareholders | | | | |

| Deborah F. Kuenstner * | Newton, MA | 54 |

| | 2007 |

| William J. Shea * | North Andover, MA | 65 |

| | 2004 |

| | | | | |

| Directors Whose Terms Expire at the 2015 Annual Meeting of Shareholders | | | | |

| Herbert S. Alexander * | Westborough, MA | 70 |

| | 1991 |

| Lynn Thompson Hoffman * | Santa Fe, NM | 64 |

| | 1994 |

| John Morton III * | Annapolis, MD | 69 |

| | 2008 |

| | | | | |

| |

(1) | Includes service as a director of Boston Private Bank & Trust Company ("Boston Private Bank"), a wholly-owned subsidiary of the Company, prior to the formation of the holding company structure in 1988. |

| |

(2) | Nominee for re-election. |

Director and Nominee Qualifications

This section provides information as of the date of this Proxy Statement about each member of the Company's Board of Directors, including the nominees for election or re-election at the Meeting. The biographical description below for each nominee includes the specific experience, qualifications, attributes and skills that led to the conclusion by the Board of Directors that such person should serve as a Director of the Company. The biographical description below for each Director who is not standing for election includes the specific experience, qualifications, attributes and skills that the Board of Directors would expect to consider if it were making a conclusion currently as to whether such person should serve as a Director. The Board of Directors did not currently evaluate whether the Directors who are not standing for re-election at this Meeting should serve as Directors, as the terms for which they have been previously elected continue beyond the Meeting.

In addition to the information presented below regarding each Director'sDirector’s specific experience, qualifications, attributes and skills, the Board also believes that all of the Directors have a reputation for integrity, honesty and adherence to high ethical standards. They each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment to service to the Company.

Herbert S. Alexander. Mr. Alexander became a DirectorThe Board has determined that each nominee, except Messrs. Deutsch and Thompson, qualifies as an independent director under the NASDAQ listing standards.

If any of the Company in 1991. He is founder and Chairmannominees shall become unavailable for any reason, all proxies will be voted FOR the election of Alexander, Aronson, Finning & Co., P.C., a firm of certified public accountants and consultants established in 1973. Mr. Alexander is the Chief Financial Officer and a director of Wirefab, Inc., a manufacturer of aluminum, steel and stainless steel wire products, established in 1955. He serves on the Investment Committee of Morgan Memorial Goodwill Industries in Boston, Massachusetts. He formerly served onsuch other person as the Board of Directors may recommend.

The Board of Directors unanimously recommends a vote FOR each of its nine director nominees.

INFORMATION REGARDING DIRECTOR NOMINEES

The following table sets forth certain information regarding the nominees for election at the 2015 Annual Meeting of Shareholders, based on information furnished by them to the Company:

|

| | | | | |

| | Age | | Director Since | | Independent |

| Board Nominees | | | | | |

| Clayton G. Deutsch | 59 | | 2010 | | NO |

| Deborah F. Kuenstner | 56 | | 2007 | | YES |

| Gloria C. Larson | 64 | | 2015 | | YES |

| John Morton III | 71 | | 2008 | | YES |

| Daniel P. Nolan | 62 | | 2014 | | YES |

| Brian G. Shapiro | 61 | | 2014 | | YES |

| Mark D. Thompson | 58 | | Nominee | | NO |

| Stephen M. Waters, Chairman of the Board | 68 | | 2004 | | YES |

| Donna C. Wells | 53 | | 2014 | | YES |

| | | | | | |

Director Nominee Qualifications

This section provides information as of the Massachusetts Societydate of Certified Public Accountants andthis Proxy Statement about each nominee for election or re-election at the Massachusetts Easter Seal Society. Additionally, heMeeting. It is aexpected that each member of the Advisory Council of the Northeastern University Graduate School of Professional Accounting, and is a Trustee of the Worcester Art Museum, where he is the Chairman of its Audit Committee and a member of the Finance Committee. Mr. Alexander was President and Chairman of the Board, of Directors of the International Association of Practising Accountants from November 2006including nominees, if elected, will also be appointed to October 2009. Mr. Alexander is also on the board of directors of Boston Private Bank & Trust Company. With his years of specific experience as the named partner of Alexander, Aronson, Finning & Co.Company (the “Bank”), P.C., Mr. Alexander brings to the Board of Directors invaluable business, financial, accounting and management experience. Mr. Alexander's experience, which also includes membership in various professional societies, and his service on a number of audit committees, has provided him with valuable experience dealing with the evaluation of financial statements, accounting principles and financial reporting rules and regulations.

Eugene S. Colangelo. Mr. Colangelo joined our Board in 1987. He is Chairmanwholly-owned subsidiary of the Board of Julio Enterprises and has served as such since the early 1980s. Julio Enterprises, a conglomerate headquartered in Westborough, Massachusetts, operates numerous businesses including retail, publishing and real estate. He was formerly a member of the Board of Directors of Morgan Memorial Goodwill Industries in Boston, Massachusetts, andCompany. Each nominee is currently a member of that organization's Retail Oversight Committee. Mr. Colangelo has served as Chairmanthe board of directors of the Board of Directors of Boston Private Bank & Trust Company since 1999. The Board believes that Mr. Colangelo's extensive entrepreneurial experience and understanding of what makes a business run effectively and efficiently make him an effective member of the Board of Directors. Further, his long-standing involvement with the Company's largest affiliate, Boston Private Bank & Trust Company, and his extensive contacts in the local community, provide insights that are particularly valuable for the Board and, combined, make him an excellent candidate for membership on the Board.Bank. For more information see “Corporate Governance.”

Clayton G. Deutsch. Deutsch

Mr. Deutsch is Chief Executive Officer and President of the Company, which he joined in August 2010. Mr. Deutsch is a member of the Company'sCompany’s Leadership Team and has over 30 years of experience in the financial services industry. He began his career in banking in the 1970s beforeat Society Corporation, the predecessor to Key Corp. Prior to joining McKinsey &the Company, in 1980. Most recently, he was a director at McKinsey & Company, which he joined in 1980, and served as Global Leader of that firm'sfirm’s Merger Management Practice. During his time at McKinsey, he developed deep experience working with many leading financial institutions, with a particular focus in the private banking, wealth advisory, and wealth management sectors, as he helped establish and build McKinsey'sMcKinsey’s Financial Services practice globally. As a senior leader at McKinsey, Mr. Deutsch managed the Midwest complex of McKinsey offices including Chicago, Pittsburgh, Minneapolis, Cleveland and Detroit, and founded and led the Great Lakes Financial Services practice. Throughout his career with McKinsey, he consulted with financial services providers and other businesses on global strategy development, performance improvement, M&A strategy and corporate governance, among other areas. Mr. Deutsch also served as Chairman of McKinsey'sMcKinsey’s Principal Review Committee, a member of the Director Review Committee, a long-time member of the Shareholders Council (McKinsey's(McKinsey’s board of directors) and Chair of the Professional Standards Committee. Before joining McKinsey, he began his career at Society Corporation, the predecessor to KeyCorp. In addition to Mr. Deutsch'sDeutsch’s management expertise, he brings to our Board extensive knowledge of financial services strategies. His skills at directing corporate strategy provide our Board with a valuable resource as the Company manages throughexpands its recent restructuring and repositions.strategic direction. Mr. Deutsch'sDeutsch’s extensive experience in the financial services industry and deep strategic expertise make him an excellent candidatenominee for the Board.

Lynn Thompson Hoffman. Mrs. Hoffman is an independent director, private investor and former real estate developer specializing in historic renovations in Boston. She served as the Lead Director of the Company from 2005 to 2010, chairs the Compensation Committee, and previously chaired the Finance and Governance Committees of the Board. She has previously served on the two principal banking subsidiary boards of the Company, Boston Private Bank & Trust Company, in Boston, Massachusetts and Borel Private Bank & Trust Company in Northern California prior to its merger into Boston Private Bank & Trust Company. She chaired the Loan Committee at Boston Private Bank and served on its Audit Committee. Her bank board service spans three decades, beginning as a Director of First Mutual Savings Bank in Boston, Massachusetts. With a Juris Doctorate from Boston University School of Law, Mrs. Hoffman is a retired member of the Boston Bar Association. Her professional experience includes investment banking with Paine Webber and executive management with Houghton Mifflin Company. She currently serves as an advisor to the New Mexico State

Investment Council Investment Committee which manages $16 billion in sovereign wealth assets for the citizens of the state. As a graduate of Pitzer College in Claremont, California and a former resident of Atherton, California, Mrs. Hoffman has geographic knowledge of both the Boston and Northern California areas. She presently resides in Santa Fe, New Mexico and Punta Mita, Mexico and is fluent in Spanish. She has extensive non-profit board experience and community involvement including the Santa Fe Opera, New Mexico Museum Foundation, Massachusetts Society for the Prevention of Cruelty to Children, Babson College, the New England Conservatory and Harvard Community Health Plan. Ms. Hoffman contributes board leadership, real estate and investment banking experience, executive management, legal knowledge and geographic diversity.

Deborah F. Kuenstner.

Ms. Kuenstner is the Chief Investment Officer atof Wellesley College. Before joining Wellesley College in February of 2009, Ms. Kuenstner was Chief Investment Officer and Vice President of Investment Management at Brandeis University from 2007 to January 2009. Prior to working at Brandeis, Ms. Kuenstner was Managing Director of Research for Fidelity Management & Research Company, the investment management organization of Fidelity Investments. Ms. Kuenstner was the Chief Investment Officer, Global Value, at Putnam Investments from 2000 to 2004. Her other roles at Putnam included Chief Investment Officer, International Value and Senior Portfolio Manager, International Equities. Prior to that, she worked at DuPont Pension Fund Investment in Wilmington, Delaware as a Senior Portfolio Manager, International Equities. Ms. Kuenstner has also been a Vice President, International Investment Strategist, at Merrill Lynch, in addition to Economist at the Federal Reserve Bank of New York. Ms. Kuenstner was actively involved in the Board of Pensions of the Presbyterian Church USA from 1996-2004 as Investment Committee Chair, Director, and most recently, Co-opted Director. Ms. Kuenstner brings to the Board valuable

experience and knowledge about the financial services industry generally and, in particular, the investment management arena, alongarena. Along with this experience, her economic and risk management expertise.expertise make her an excellent nominee for the Board.

Gloria C. Larson

Ms. Larson was elected to Board in January 2015. She currently serves as the President of Bentley University and is the first woman to hold this position. Ms. Larson formerly served as the Co-Chair of the Government Strategies Group at Foley Hoag LLP, and from 1996 until 2007 managed a practice that covered a broad array of federal, state and local regulatory and business development issues. Widely influential in economic policy, Ms. Larson was Secretary of Economic Affairs for the Commonwealth of Massachusetts from 1993 to 1996 and was responsible for developing and promoting economic growth policies and fostering employment opportunities. She served as the Commonwealth of Massachusetts Secretary of Consumer Affairs and Business Regulation from 1991 to 1993, where she was responsible for regulatory oversight of banking, insurance and energy, as well as consumer protection. Prior to her state service, she oversaw business and regulatory issues at the federal level as a senior official with the Federal Trade Commission (FTC), where she served as Deputy Director of Consumer Protection from 1990 to 1991 and as Attorney Advisor to Commissioner Patricia P. Bailey from 1981 to 1988. Ms. Larson has been honored and recognized by many groups for her contributions to state economic development policy and her commitment to civic engagement. Ms. Larson currently serves as a member of the Council of Economic Advisors, as well as the Massachusetts Clean Energy Center and the Commonwealth’s Successful Women, Successful Families Task Force. Ms. Larson is a member of the Executive Committee of the American College and University Presidents Climate Commitment and a member of the Liberal Education and America’s Promise (LEAP) Presidents’ Trust. She served for more than a decade as Chairman of the Massachusetts Convention Center Authority (MCCA), was the first woman to serve as Chairman of the Greater Boston Chamber of Commerce, where she continues to serve on the Chamber’s Executive Committee. Ms. Larson presently holds the post of President of the Massachusetts Conference for Women. In addition, she is a board or advisory council member of several prominent professional, charitable and civic organizations. In addition to serving on the Company’s Board of Directors, Ms. Larson currently serves as a Director of Unum Group, chairing Unum’s Regulatory Compliance Committee. She previously served as a director on the boards of KeySpan Energy and RSA Security, as well as a member of the board of Blue Cross Blue Shield of MA. Ms. Larson’s deep ties in the Boston community, as well as her public company and financial sector experience, will be of great value to the Company as it continues to focus on its strategic goal of becoming a premier national wealth management and private banking company. We believe that Ms. Larson’s expertise in the regulatory oversight of banking and the financial services industry, and her experience managing regulatory and business development issues qualify her as an excellent nominee for the Board.

John Morton III.

Mr. Morton is a seasoned bank executive with over 35 years of banking and financial services experience. He has extensive experience leading organizational turnarounds, acquisition integrations, business growth and corporate governance activities. Mr. Morton was a director of Fortress International Group, Inc. from January 2007, and served as Chairman from December 2008 to January 2012, when he resigned from the Board.board. Mr. Morton served as an advisor to Fortress International Group, Inc.'s Board’s board through the first quarter of 2012. He has been a Director of the Company since August 2008, of Barry-Wehmiller Companies, Inc. since July 2007, and Dynamac International Inc,Inc., from the late 1980s until it was sold in early 2010. Mr. Morton served as a Directordirector of Broadwing Corporation from April 2006 to January 2007. He served as President of Premier Banking for Bank of America Corp. from August 2004 to September 2005. From 1997 to 2001, Mr. Morton served as President of the Mid-Atlantic Region, Bank of America. He was President of the Private Client Group of NationsBank from 1996 to 1997. From 1994 to 1996, he served as Chairman, and Chief Executive Officer and President of The Boatmen'sBoatmen’s National Bank of St. Louis, and as Chief Executive Officer of Farm and Home Financial Corporation from 1992 to 1993. In 1990 and 1991, Mr. Morton served as Perpetual Financial Corporation'sCorporation’s Chairman, Chief Executive Officer and President. He served in the U.S. Navy as a lieutenant aboard the nuclear submarine U.S.S. George Washington Carver. He serves as Chairman of the Maryland Stadium Authority, as Commissioner of the Maryland State Lottery and Gaming Control Commission, Director, U.S. Naval Institute, and Directordirector of the U.S. Naval Academy Foundation Athletic and Scholarship Programs. We believe Mr. Morton'sMorton is a valuable nominee for the Board in light of his experience as the chairman, chief executive officer and president of several banking institutions, coupled with his service on a number of public company boards, allows him to bringboards. He brings to the Board operational expertise, a deep background in the financial services industry, and a comprehensive understanding of the Company's business.Company’s business, all of which make him particularly qualified and an excellent nominee to serve on the Board.

Daniel P. Nolan

William J. Shea. Mr. Shea is the Executive ChairmanNolan currentlyserves as President and CEO of Caliber ID, Inc. (formerly Lucid,Inc.)Hugh Johnson Advisors, LLC, a manufacturer of in-vivo and ex-vivo cellular imaging equipment, basedregistered investment advisor located in Rochester,Albany, New York. He wasMr. Nolan is also a managing partner of DLBprincipal in NPV Capital LLC, a start-up private equity company locatedand real estate investment firm that he formed in Wilton, Connecticut until DecemberJuly 2007. Prior to holding these positions he was a partner in Ayco Company, L.P., a wholly owned subsidiary of Goldman Sachs. During his twenty-eight year career, from August 1978 through April 2007, at Ayco, Mr. Nolan provided tax, investment and financial planning advice to Ayco’s highest net worth clients. He served as Executive Chairmana Regional Vice President of Royaltwo of Ayco’s regional offices and held a variety of management positions, serving on both the Senior Management Committee and

the Strategic Planning Committee. Mr. Nolan founded and led the firm’s Special Investment Group, creating venture capital, private equity and hedge fund opportunities for the firm’s clients. In July 2003, Ayco was sold to The Goldman Sachs Group and Mr. Nolan led the effort to integrate Ayco into Goldman’s Private Wealth Management practice. He previously served on the board of Capital Bank & Sun Alliance USA, Inc. from 2005 to 2006.Trust, a community bank headquartered in Albany, New York. Mr. Shea servedNolan is a trustee of Albany Law School as President and Chief Executive Officerwell as The College of Conseco, Inc. from 2001 to 2004, where he successfully managed that firm's restructuring process. Prior to joining Conseco,St. Rose. Mr. Shea served as ChairmanNolan is a member of the Boardboard of directors of NSC de Puerto Rico, Inc. and the Center for Centennial Technologies,Disability Services Endowment and a public manufacturing company. Mr. Shea also served as Vice Chairman and Chief Financial Officer of BankBoston, Inc. prior to its acquisition by Fleet Financial Group in 1999, where he had responsibility for all financial aspectsmember of the corporation, investor relations, riskCollege Affairs Committee of the Albany Medical Center Board of Directors. Mr. Nolan’s proven business acumen, as demonstrated by his success in founding and leading several companies, is a valuable resource as the Company continues to build on its current strategy. He has significant leadership, operational and investment management capital markets and private banking, among other areas. He began his career infinancial expertise. Further, Mr. Nolan offers the financial services area with Coopers & Lybrand, where he spent twenty years,Board a unique perspective into a number of important areas including strategic planning and rose to serve as Vice Chairman and Firm Council Member. He serves as Chairman ofwealth management. We believe that Mr. Nolan’s extensive experience make him an excellent nominee for the Board of World Gold Trust Services, Inc. (WGTS) which hasDirectors.

Brian G. Shapiro

Mr. Shapiro is a CPA and serves as its mainthe Managing Partner of The Shapiro Group, a Los Angeles based boutique CPA firm that he founded. The firm specializes in strategic planning for taxes, investments and business the second largest ETFdecisions of high net worth individuals, pass-thru entities and corporations. Prior to forming The Shapiro Group in 1983, Mr. Shapiro served as Tax Manager for Arthur Young & Company, where he was designated a national firm specialist for securities transactions and investment planning. Mr. Shapiro is active in community and philanthropic organizations in the world (approximately $70 billion in market capitalization holding physical gold) trading underLos Angeles community and organizations connected with the symbol GLD onUniversity of Wisconsin-Madison. He is a past president of the NYSE Arca Exchange. Mr. Shea formerly served onUniversity of Wisconsin Alumni Club of Los Angeles, an emeritus member of the Dean’s Advisory Board of The Wisconsin School of Business and a member of the Executive

Committee forUniversity of Wisconsin Bascom Hill Society. He is also an active member of the Boston Stock ExchangeWater Buffalo Club, a Los Angeles charity support group, and the BoardsBig Ten Club of Trustees for Children's Hospital Boston and Northeastern University.Southern California. Mr. Shea hasShapiro served as the Chairman of the Board of Demoulas Supermarkets since 1999First Private Bank & Trust from April 2008 until its merger into Boston Private Bank & Trust Company in 2011. He currently chairs the Company’s and serves on the BoardsBank’s Risk Management Committee. Mr. Shapiro’s expertise in finance, investment management and accounting make him a vital asset in the continued growth of AIG SunAmericathe Bank and NASDAQ OMX BX. Mr. Shea is also onthe Company. His previous tenure as a director at Boston Private Bank & Trust Company provides the Board of Directors additional insight into the Bank’s operations and business. We believe Mr. Shapiro’s extensive experience and financial expertise make him an excellent nominee for the Board of Directors.

Mark D. Thompson

Mr. Thompson is the chief executive officer and president of Boston Private Bank & Trust Company and is also a member of the Bank’s board of directors. He has been a member of the Company’s Leadership Team since September 2010. In his role as CEO of the Bank, Mr. Thompson is responsible for the overall performance of Boston Private Bank & Trust Company. Mr. Shea's experience as a chief executive officer of a public insurance companyHe joined Boston Private Bank & Trust Company in 1994 and as a chief financial officer of a bank, as well as his work on various public company boards, allows Mr. Shea to bring relevant and extensive business, management, banking, accounting and operational experience to the Board.

Dr. Allen L. Sinai. Dr. Sinai has been President, Chief Executive Officer and Chief Global Economist/Strategist of Decision Economics, Inc. since 1996. Decision Economics, Inc. is a U.S. and global economic and financial information and investment advisory firm located in New York, London and Boston serving mainly financial institutions. Dr. Sinai is responsible for Decision Economics, Inc. forecasts and analysis of the U.S. and world economies and financial markets, tactical and strategic asset allocation, and for translating this information for use in bottom-line decisions by senior level decision-makers in financial institutions, corporations and government. Dr. Sinai is also responsible for the business operations and financial performance of Decision Economics, Inc. Previously, Dr. Sinai served for over 13 years at Lehman Brothers, where he was Managing Director and Chief Global Economist, and the Director of Lehman Brothers Global Economics. He also served as Executive Vice President and Chief Economist of The Boston Company, a subsidiary of Shearson Lehman Brothers. Prior to Lehman Brothers, Dr. Sinai was Chief Financial EconomistTreasurer from 1994-2001, President from 2001-2003 and Senior Vice President at the Lexington, Massachusetts based Data Resources, Inc. and Co-Chair of DRI's largest business unit, the Financial Institution Group. Dr. Sinai has taught at numerous universities, including Brandeis, the Massachusetts Institute of Technology, Boston University, New York University and the University of Illinois-Chicago. He is a past President and Fellow of the Eastern Economic Association and a past President of the North American Economics and Finance Association. He has been Chairman of the Committee on Developing American Capitalism and a past member of the Time Magazine Board of Economists. Dr. Sinai's extensive business and financial services industry experience and understanding, his background as Chief Executive Officer from 2003 to the present. Prior to joining the Bank, Mr. Thompson was an Executive Vice President and Chief Economistfounding officer of Wainwright Bank & Trust Company and was Vice President - Private Banking at Decision Economics Inc.,Boston Safe Deposit & Trust Company. Mr. Thompson’s extensive experience in banking and his knowledge and deep contacts in finance, government and industry, U.S and globally, makeas leader of Boston Private Bank & Trust Company makes him a sophisticated contributor on the Board and an excellent candidate.nominee for the Board.

Stephen M. Waters.

Mr. Waters is Chairman of the Board of the Company and the Bank, and is Managing Partner of Compass Advisers GroupPartners Advisors LLP and its advisory and investment subsidiaries, which he founded in 1996. Prior to this, Mr. Waters spent over twenty years advising corporate and financial entities both in the U.S. and internationally. Mr. Waters served from 1992 to 1996 as Co-Chief Executive Officer of Morgan Stanley Europe and was a member of Morgan Stanley'sStanley’s worldwide 12-person Operating Committee. Mr. Waters joined Morgan Stanley as a Managing Director in the Mergers and Acquisitions Department in June 1988 and was Co-Director of that department from January 1990 to early 1992. Mr. Waters was Co-Director of the Mergers and Acquisition Department at Shearson Lehman Brothers from 1985 to 1988. He serves on the Board of Directors of Valero Energy Corporation where he sits on the audit and compensation committees. Mr. Waters brings over thirty-five35 years of specific and relevant financial services experience to the Board, along with a deep understanding and practical knowledge of the investment management business. Mr. Waters'Waters’ background as a chief executive officer and director, as well as his extensive experience in investment management, economics and mergers and acquisitions makes him an excellent candidatenominee for the Board.

Donna C. Wells

Ms. Wells became a member of the Company’s Board of Directors in July 2014. She is currently Board Director, President and CEO of Mindflash Technologies, Inc., a private, Palo Alto, California company providing the market-leading cloud-based platform for employee and customer training. Prior to Mindflash, Ms. Wells had a nearly 20 year career in the financial services industry, including experience leading transitions from offline to online business models within Fortune 1000 companies and successfully disrupting established players with small, start-up teams as a serial entrepreneur. Ms. Wells began her career at American Express as a member of the Corporate Strategic Planning group and later held positions of increasing responsibility

in that company’s Consumer and Corporate Card businesses. She later helped establish a new, strategic product development function for Charles Schwab’s retail business and ultimately held responsibility for product development and marketing to customer segments representing 70% of all Schwab client households. This early experience with the power and scale afforded by online financial service delivery drove Ms. Wells to leadership roles with three of the most innovative companies in this space: MyCFO Wealth Management (sold to Harris Bank), Intuit and Mint.com (sold to Intuit). Ms. Wells’s teams’ work has won multiple Webby’s (the “Oscars of the Internet”) and recognition as a Tech Pioneer by the World Economic Forum in Davos. She has been named a Top 25 Women in Tech to Watch by Accenture and a Marketing Executive of the Year Finalist by the Wall Street Journal. Ms. Wells is a native Californian and returned to live in the Bay Area in 1995, following 14 years on the East Coast and in Asia. Ms. Wells’ extensive experience in the financial services industry and her expertise surrounding online financial service delivery qualifies her as an excellent nominee to serve on the Board of Directors.

CORPORATE GOVERNANCE

The business of the Company is managed under the direction of the Company'sCompany’s Board of Directors in accordance with the Massachusetts General Laws and the Company'sCompany’s Restated Articles of Organization and by-laws. The Board of Directors provides oversight of the Company'sCompany’s activities for the benefit of its shareholders and other constituencies, which includes the Company'sCompany’s regulators, affiliated companies, employees, customers, suppliers, creditors and the communities in which the Company and its affiliates conduct business. The table below lists many of our governance practices.

|

| |

| Board and Other Governance Information | |

| Majority Voting for Directors | Yes |

| Annual Election of All Directors | Yes |

| Diverse Board (as to Gender, Composition, Skills, Experience, etc.)* | Yes |

| Annual Board and Committee Self-Evaluation | Yes |

| Separate Chairman and CEO | Yes |

| Independent Directors Meet Without Management at Each Regularly Scheduled Board Meeting | Yes |

| Annual Independent Director Evaluation of CEO | Yes |

| Code of Business Conduct and Ethics for Directors | Yes |

| Board Level Risk Management Committee | Yes |

| Size of Board* | 9 |

| Number of Independent Directors* | 7 |

| Average Director Age* | 62 |

| Average Director Tenure (in Years)* | 4.5 |

| Annual Equity Grant to Directors | Yes |

| Disclosure Committee for Financial Reporting | Yes |

| *Based on nominated Board | |

Corporate Governance Guidelines

The Board of Directors has a particular focus on corporate governance, developing the strategic direction of the Company, and seeking to ensure the success of the Company'sCompany’s business through the appointment and retention of qualified executive management. The Board is committedhas documented its commitment to strongserve the best interests of the Company and its shareholders in its Corporate Governance Guidelines which, among other things, describe our corporate governance practices and is responsible for ensuring that the Company's business is conducted in a responsible manner with integrityaddress issues such as director qualification standards, director responsibilities, board composition and high ethical standards.structure, performance evaluation and succession planning.

Board Leadership Structure

In accordance with the Company'sCompany’s by-laws, the Board of Directors elects the Chairman of the Board and appoints the President, who also serves as Chief Executive Officer ("CEO"(“CEO”). The Board of Directors has adopted a policy that provides for the separation of the roles of Chairman and Chief Executive Officer.

The Compensation, Governance and Executive Committee has established a Statement of Roles and Responsibilities ("Statement"(“Statement”) for the non-executive Chairman of the Board.Board of Directors (“non-executive Chair”). The Statement provides that

the position of non-executive Chairman may only be held by a

member of the Board of Directors who has been determined to be "independent"“independent” under the Marketplace Rules of the Financial Industry Regulatory Authority applicable to NASDAQ-listed companiesNASDAQ listing standards (the "NASDAQ Rules"“NASDAQ Rules”). The non-executive Chairman is to be elected by the Company'sCompany’s Board of Directors annually and may be removed at any time with or without cause. The non-executive Chairman of the Board is responsible for the management, development and effective functioning of the Board of Directors and provides leadership in every aspect of the Board'sBoard’s oversight of the Company. The non-executive Chairman of the Board acts in an advisory capacity to the Chief Executive OfficerCEO and President of the Company, and to other executive officers in matters concerning the interests of the organization and the Board, as well as serving as the liaison between management and the Board.Board of Directors. The duties of the Chairman of the Board include the following:

setting agendas for the Board meetings in consultation with the Chief Executive Officer;CEO;

chairing Board meetings and ensuring that Board functions are carried out effectively;

establishing and chairing executive sessions of independent directors and providing feedback to the Chief Executive Officer,CEO, as appropriate;

serving as liaison for chairs of affiliated company boards;

facilitating the Board'sBoard’s efforts to create and maintain practices that respond to feedback from shareholders and other stakeholders;

representing the Board at meetings with major shareholders and other stakeholder groups on governance related matters, as may be requested from time to time;

providing advice to the Chief Executive OfficerCEO on majorstrategic and or material issues;

facilitating effective communication between directorsDirectors and management, both inside and outside of meetings of the Board;

working with the Chief Executive OfficerCEO to ensure management strategies, plans and performance are appropriately risk assessed and representedpresented to the Board;

advising management in the planning of the strategy meeting; and

performing such other duties as the Board may from time to time delegate.

The Compensation, Governance and Executive Committee conducts a periodic review of the role and responsibilities of the non-executive Chairman each year, and this review is then presented to the full Board of Directors.

Risk Oversight

The Board of Directors plays an important role in the risk oversight of the Company and is involved in risk oversight through direct decision-making authority with respect to significant matters, including the development of limits and specific risk tolerances, and the oversight of management by the Board of Directors and its committees. The Board of Directors and its committees also are each directly responsible for considering risks and the oversight of risks relating to decisions that each committee is responsible for making. In light of the Company'sCompany’s overall business and market, the extensive regulatory schemes under which the Company and all of its affiliates operate, and the complexities of the Company'sCompany’s operations as a whole, the Board has established a Risk Management Committee which is tasked with specific responsibility for direct oversight of all of the risks inherent in the Company'sCompany’s business, along with management of the enterprise-wide risk management program. The Risk Management Committee consults with each of the other committees of the Board of Directors for an analysis of their areas of risk, as well as with management and outside experts, and provides regular, detailed reporting and recommendations on risk-related actions to the full Board. The Risk Management Committee also monitors the risk management function and conducts risk assessments for all of the Company'sCompany’s subsidiaries, participates directly in the risk management committee meetings of Boston Private Bank & Trust Company, (the "Bank"), which is the Company'sCompany’s largest subsidiary, adopts and directs the implementation of risk management policies that relate to both the Company and its subsidiaries, and analyzes reporting regarding the same.

In addition to the Risk Management Committee, the Board of Directors administers its risk oversight function through (1) through:

the review and discussion of regular, periodic reports to the Board of Directors and its committees on topics relating to the risks that the Company faces, including, among others, credit risk, market risk, interest rate risk, operational risks, and regulatory risk and various other matters relating to the Company's business; (2) risk;

the required approval by the Board of Directors (or a committee thereof) of significant transactions and other decisions, including, among others, final budgets, material uses of capital, strategic direction, and executive management hiring and promotions; (3)

the direct oversight of specific areas of the Company'sCompany’s business by the Risk Management Committee, the Audit and Finance Committee, the CompensationWealth Management/Trust and Investment Committee, and the Compensation, Governance and Executive Committee; and (4)

regular periodic reports from the Company'sCompany’s internal and external auditors and other third party consultants regarding various areas of potential risk, including, among others, those relating to the Company'sCompany’s internal

controls and financial reporting.

The Board of Directors also relies on management to bring significant matters impacting the Company and its subsidiaries to the Board'sBoard of Directors’ attention.

Risk Review and Analysis

The Company'sCompany’s Chief Risk Officer and Director ofChief Human Capital Resources Officer discuss, evaluate and review the Company'sCompany’s compensation programs annually as part of the Company'sCompany’s management risk review process. The findings of this review are presented to the Compensation, Governance and Executive Committee annually for further evaluation and discussion with particular focus on the following key areas: (1) the compensation plans of the persons identified as named executive officers ("NEOs"(“NEOs”) in this Proxy Statement to ensure that such plans do not encourage the NEOs to take unnecessary or excessive risks that threaten the value of the Company; (2) employee compensation plans in light of the risks posed to the Company by such plans and how to limit these risks; and (3) employee compensation plans to ensure these plans do not encourage the manipulation of reported earnings to enhance compensation. NEO Compensation Plans are described in detail in "“Compensation Discussion and Analysis."”

The Compensation, Committee'sGovernance and Executive Committee’s review focuses on incentive compensation plans (asas opposed to base salary plans or standard benefit arrangements),arrangements, as the Company believes that incentive compensation arrangements have the greatest potential to encourage inappropriate risk-taking, and/or encourage the manipulation of earnings to enhance compensation. The Company also believes that its base salary and benefit arrangements are generally reasonable (i.e., not excessive) and appropriate, considering the Company'sCompany’s compensation philosophy and industry and regional differences.

The Compensation, Governance and Executive Committee evaluated each plan using the following risk categories: acceptable to low risk, moderate level of risk, and significant risk/potential for material adverse impact. The majority of the Company'sCompany’s incentive compensation plans were rated in the "acceptable“acceptable to low risk category." Any "moderate level of risk" concern areas were considered immaterial and the” The Company believes appropriate mitigants are in place to minimize the risk for permitting unnecessary and inappropriate risk-taking or encouraging the manipulation of earnings to enhance compensation. Such mitigants include the addition of mechanisms to claw-back compensation, enhanced governance processes for compensation reviews and the on-going monitoring of employee compensation that may trigger automatic individual or plan reviews. In addition, steps have been taken, and there are continuing efforts to implement additional mitigants, such as expanding discretion over formulaic incentive plans, synchronizing the timing of payment under all employee plans, segregating decision making authority under certain compensation plans, and ensuring adequate internal controls through periodic reviews of all plans.

The Compensation, Governance and Executive Committee believes that the balance of base compensation, variable annual incentive bonuses determined based on Company and individual performance, and long-term equity incentive compensation is weighted such that excessive or unnecessary risk taking will not be encouraged by the variable elements of compensation. Further, the Compensation, Governance and Executive Committee believes that the long-term equity components of compensation encourage the Company'sCompany’s executives to focus on elements of the Company'sCompany’s performance to influence long-term value creation and share price appreciation.

Committees of the Board and Related Matters

The Board of Directors currently has fivefour standing Committees: the Audit and Finance Committee,Committee; Compensation, Committee,Governance and Executive Committee; Risk Management Committee,Committee; and Wealth Management CommitteeManagement/Trust and GovernanceInvestment Committee. The following table sets forth membership on the Committees and the number of meetings held during 2012.

|

| | | | | | | | | | |

| | | | | | | | | | | |

Name | | Audit and Finance | | Compensation | | Governance | | Risk Management | | Wealth Management Committee(3) |

| Herbert S. Alexander | | l | | | | | | l | | |

| Eugene S. Colangelo | | | | l | | Chair | | | |

|

| Lynn Thompson Hoffman | | | | Chair | | l | | | | l |

| Deborah F. Kuenstner(1) | | | | l | | l | | Chair | | Chair |

| John Morton III | | l | |

| |

| | l | | l |

| William J. Shea(2) | | Chair | | l | | l | | | |

|

| Allen L. Sinai | | l | | | | | | l | | |

| Stephen M. Waters | | | | l | | l | | | |

|

| Number of Committee Meetings Held in 2012 | | 12 | | 8 | | 8 | | 12 | | 5 |

| | | | | | | | | | | |

| |

(1) | Deborah F. Kuenstner left the Compensation Committee as of July 2012 and joined the Wealth Management Committee as of July 2012. |

| |

(2) | William J. Shea joined the Compensation Committee as of July 2012 and left the Governance Committee as of July 2012. |

| |

(3) | The Wealth Management Committee is a joint committee with the Bank. As such, two Bank directors, John Clymer and James Schmidt, are also members of this Committee. |

Each committee was comprised solely of members of the Board of Directors who have been determined to meet the definition of "independent"“independent” in accordance with the NASDAQ Rules. All of the committees have adopted charters that provide a statement of the respective committee'scommittee’s roles and responsibilities. Current charters for those committees that are mandated under the NASDAQ RulesAudit and Finance Committee and the Compensation, Governance and Executive Committee are available in the Investor Relations/Corporate Governance section of the Company'sCompany’s website at www.bostonprivate.com.

The following table sets forth membership on the committees and the number of meetings held during 2014.

|

| | | | | | | | |

| Name | | Audit and Finance | | Compensation, Governance and Executive | | Risk Management | | Wealth Management/Trust and Investment Committee |

| Herbert S. Alexander | | Ÿ | | | | Ÿ | | |

| Lynn Thompson Hoffman (1) | | Ÿ | | Ÿ | | | | Chair (7) |

| Deborah F. Kuenstner (2) | | | | Ÿ | | Ÿ | | Ÿ |

| John Morton III (3) | | Chair (7) | | | | Ÿ | | Ÿ |

| Daniel P. Nolan (4) | | | | Ÿ | | | | Ÿ |

| Brian G. Shapiro (5) | | Ÿ | | | | Chair (7) | | |

| Stephen M. Waters | | | | Chair (7) | | | | |

| Donna C. Wells (6) | | | | | | Ÿ | | Ÿ |

| Number of Committee Meetings Held in 2014 | | 13 | | 13 | | 9 | | 9 |

| | | | | | | | | |

| |

| (1) | Lynn Thompson Hoffman left the Compensation, Governance and Executive Committee as of April 2014 and joined the Audit and Finance Committee as of April 2014. |

| |

| (2) | Deborah F. Kuenstner left the Risk Management Committee as of April 2014. |

| |

| (3) | John Morton III left the Wealth Management/Trust and Investment Committee as of April 2014. |

| |

| (4) | Daniel P. Nolan joined the Board of Directors, the Compensation, Governance and Executive Committee and the Wealth Management/Trust and Investment Committee as of April 2014. |

| |

| (5) | Brian G. Shapiro joined the Board of Directors, the Audit and Finance Committee, and the Risk Management Committee as of April 2014. |

| |

| (6) | Donna C. Wells joined the Board of Directors, the Risk Management Committee, and the Wealth Management/Trust and Investment Committee as of July 2014. |

| |

| (7) | Indicates Chair as of December 31, 2014. |

Attendance at Board and Committee Meetings, Annual Meeting

The Board of Directors held eleven meetings of the full Board during 2014. Each incumbent Director who was a Director in 2014 attended at least 75% of the aggregate number of meetings of the full Board of Directors and relevant committees. The Company does not have a policy of requiring Directors to attend the annual meeting of shareholders. The Company does, however, typically schedule a meeting of its Board of Directors the day before or close to the annual meeting of shareholders to facilitate each Director’s attendance at the annual meeting of shareholders. Of the eight members then on the Board, seven attended the Company’s 2014 annual meeting.

Executive Sessions without Management

To promote open discussion among the non-management Directors, the Board of Directors schedules regular executive sessions in which the non-management Directors meet without management’s participation. Such sessions are scheduled to occur at every regularly scheduled Board and committee meeting. The Chairman of the Board is the presiding Director at such executive sessions.

Audit and Finance Committee

Each member

The majority of members of the Audit and Finance Committee is an "audit“audit committee financial expert"expert” as defined in SEC regulations and isall members are independent as defined under the NASDAQ Rules. Pursuant to the Audit and Finance Committee'sCommittee’s charter, the Audit and Finance Committee assists the Board in its oversight of (1) the process of reporting the Company'sCompany’s financial statements; (2) the system of internal controls as it relates to financial reporting; (3) the external audit process; (4) the Company'sCompany’s process for monitoring compliance with laws and regulations;regulations and code of conduct; (5) the review and approval of the Company's dividend;Company’s declaration of dividends; and (6) the qualifications, independence and performance of the Company'sCompany’s independent registered public accounting firm.firm in accordance with SEC regulations. The Audit and Finance Committee is solely responsible for retaining the Company'sCompany’s independent registered public accounting firm. The Audit and Finance Committee also conducts analysis and makes recommendations to the Board and management regarding the Company'sCompany’s financial planning, capital structure, capital raising, proposed acquisitions, mergers and divestitures, overall strategic planning, and financial performance, where relevant.

Risk Management Committee

The Risk Management Committee’s responsibilities are described above under “Risk Oversight.”

Wealth Management/Trust and Investment Committee

The Wealth Management/Trust and Investment Committee provides strategic direction and oversight on behalf of both the Board of Directors and the board of directors of the Bank regarding the Company’s wealth management businesses, both in the registered investment advisory affiliates and in the Bank’s Trust division. The Committee assists the boards in analyzing the optimal means of enhancing the Company’s performance and expanding its acquisition and retention of private clients through these businesses. The Committee also assists the Bank in fulfilling its fiduciary responsibilities relating to the operation of trusts and the administration of fiduciary accounts. The Committee offers oversight and guidance to management relating to capital allocations and with respect to leveraging synergies within the wealth management business.

Compensation, Governance and Executive Committee

The Compensation, Governance and Executive Committee makes recommendations to the Board of Directors, where necessary, on certain matters including, but not limited to, changes to compensation plans and the adoption of new plans, changes to the Chief Executive Officer'sCEO’s compensation and changes to Board compensation programs of the Company. In addition, the Committee serves as the Executive Committee of the Bank’s board of directors. The Compensation, Governance and Executive Committee has been delegated the authority by the Board of Directors to approve compensation matters for all executive officers. Compensation decisions relating to the Chief Executive OfficerCEO are also reviewed by the Board. For additional information on the Compensation, Committee'sGovernance and Executive Committee’s process for the consideration and determination of the executive officer and director compensation, please see "“Compensation Discussion and Analysis."”

Risk Management Committee

The Risk Management Committee's responsibilities are described above under "Risk Oversight."

Governance Committee

The Compensation, Governance and Executive Committee periodically reviews the arrangements for the overall governance of the Company by the Board of Directors and its committees and, among other things, assists the Board of Directors by evaluating the performance

of the Board and its committees, identifies individuals qualified to become members of the Board, recommends the slate of candidates to be nominated for election to the Board of Directors and on the boards at the Company'sCompany’s subsidiaries (wherewhere such membership is not otherwise mandated by contract),contract, recommends the members and the Chairschairs of the committees of the Board, adopts and implements governance practices and policies applicable to both the Company and its subsidiaries, and reviews and assesses the charters of all of the committees of the Board.

Wealth Management Committee

The Wealth Management Committee provides strategic direction and oversight on behalf of both the Board of Directors of the Company and the Board of Directors of Boston Private Bank & Trust Company (jointly the "Boards") regarding the Company's wealth management businesses, both in the registered investment advisory affiliates and in Boston Private Bank & Trust Company's Investment Management and Trust division. The Committee also assists the Boards in analyzing the optimal means of enhancing the Company's performance and expanding its acquisition and retention of private clients through these businesses.

Executive Sessions without Management

To promote open discussion among the non-management Directors, the Board of Directors schedules regular executive sessions in which the non-management Directors meet without management's participation. Such sessions are scheduled to occur at every regularly scheduled Board and committee meeting. The Chairman of the Board is the presiding Director at such executive sessions.

Board of Directors Meetings

The Board of Directors held nine meetings of the full Board during 2012. Each incumbent Director attended at least 75% of the aggregate number of meetings of the full Board of Directors and relevant committees.

Directors' Attendance at Annual Meetings

The Company does not have a policy of requiring Directors to attend the annual meeting of shareholders. The Company does, however, typically schedule a meeting of its Board of Directors the day before or close to the annual meeting of shareholders to facilitate each Director's attendance at the annual meeting of shareholders. Of the nine members then on the Board, eight attended the Company's 2012 annual meeting.

Code of Business Conduct and Ethics

The Company has adopted a Code of Business Conduct and Ethics, which applies to all of the Company's and its subsidiaries' employees, officers, and directors. In addition, the Company maintains procedures for the confidential, anonymous submission of any complaints or concerns about the Company, including complaints regarding accounting, internal accounting controls or auditing matters. Shareholders may access the Code of Business Conduct and Ethics in the Corporate Governance section of the Company's website at www.bostonprivate.com.

Consideration of Director Nominees

The Compensation, Governance and Executive Committee is responsible for identifying, assessing and recommending the slate of candidates to be nominated for election to the Board of Directors of the Company.Directors. The Compensation, Governance and Executive Committee uses a variety of methods for identifying and evaluating nominees for Director, and the Governance Committee assesses the mix of skills and the

performance of the Board as a whole on an annual basis. In the course of establishing the slate of nominees for Director each year, the Compensation, Governance and Executive Committee will consider whether any vacancies on the Board are expected due to retirement or otherwise, the skills represented by retiring and continuing Directors, and additional skills highlighted during the annual Board self-assessment process that could improve the overall quality and ability of the Board to carry out its function. In the event that vacancies are anticipated or arise, the Compensation, Governance and Executive Committee considers various potential candidates for Director. Candidates may come to the attention of the Compensation, Governance and Executive Committee through the business and other networks of the existing members of the Board or from management. The Compensation, Governance and Executive Committee may also solicit recommendations for Director nominees from independent search firms or any other source it deems appropriate, and has most recently sourced non-incumbent candidates through the retention of such independent search firms.firms and through the boards of its affiliates. When an incumbent Director is up for re-election, the Compensation, Governance and Executive Committee reviews the performance, skills and characteristics of such incumbent Director before making a determination to recommend that the full Board nominate him or her for re-election.

In light of the Board's commitment to the highest quality corporate governanceThe Compensation, Governance and the changing environment facing the financial services industry, the Board has requested that the Governance Committee develop and implement a plan over the next year to analyze opportunities to improve the effectiveness and efficiency of the Board structure, including an analysis of both the composition and size of the Board as a whole, as well as for the boards of the Company's subsidiaries.

The GovernanceExecutive Committee requires all nominees and candidates to possess the highest personal and professional ethics, integrity and values; to be committed to representing the long-term interests of our shareholders; to be able to devote the appropriate amount of time to be consistently informed about the Company'sCompany’s business and strategy, with a balanced perspective, strong business and financial acumen; and the ability to approach all decision making with a high level of confidence and independence. In addition to reviewing a candidate'scandidate’s background and accomplishments, candidates are reviewed in the context of the current composition of the Board of Directors and the evolving needs of the Company.

Following the 2014 annual meeting, the Board of Directors sought to recruit additional Board members whose qualifications aligned with the Company’s long-term strategy. After considering a number of candidates submitted by directors, management and a third-party search firm, the Board recommended that Ms. Wells and Ms. Larson be elected to the Board.

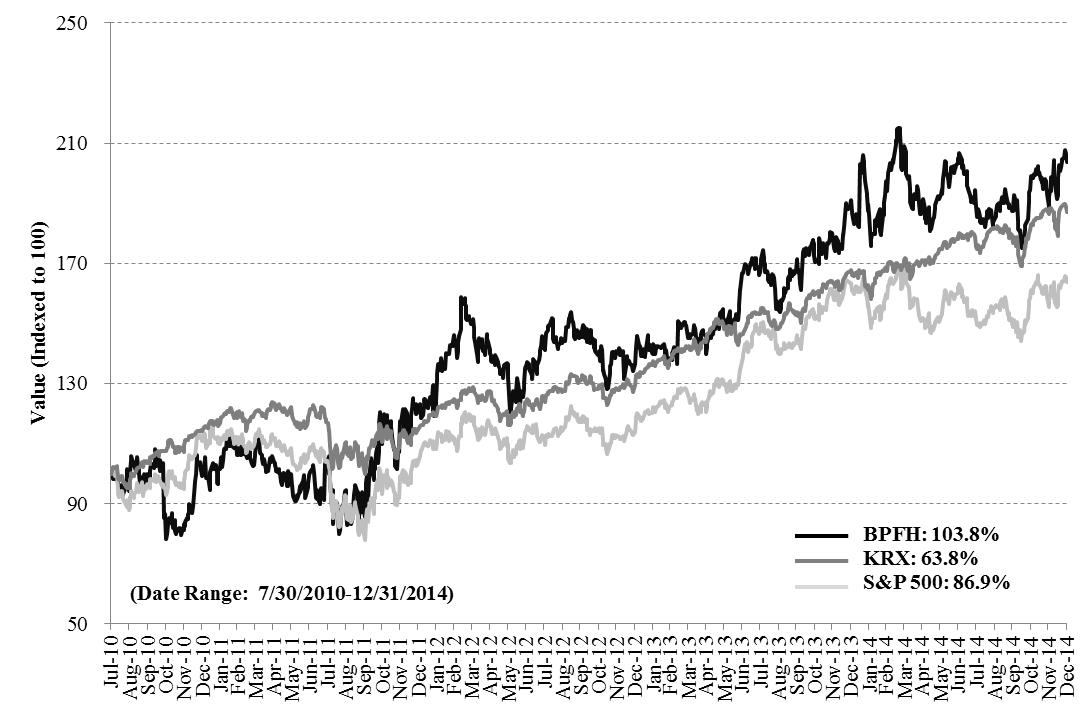

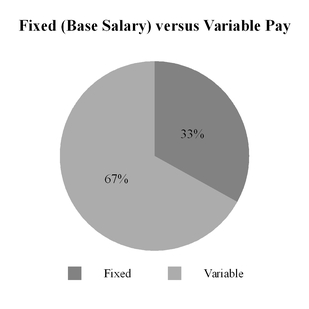

Pursuant to guidelines established by the Board, no more than twothe CEO of the Company will always be a member of the Board, the CEO of the Bank may serve as a member of the Board and all other members of the Board canmust be executive members, and all others must meet the definition of "independent"“independent” under the NASDAQ Rules. On an annual basis, the Compensation, Governance and Executive Committee reviews the "independent"“independent” status of each member of the Board to determine whether any relationship is inconsistent with a determination that the Director was independent. The most recent review was undertaken in January of 20132015 and, as a result, the Board, after review and recommendation by the Compensation, Governance and Executive Committee, determined that each of the Company'sCompany’s non-executive directors (Ms.(Mses. Kuenstner, Larson and Wells, Mrs. Hoffman and Messrs. Alexander, Colangelo, Morton, Shea, Sinai,Nolan, Shapiro and Waters) meets the qualifications for independence in accordance with the NASDAQ Rules.